INFORMATION REGARDING TAXATION FOR SELF-EMPLOYED PEOPLE.

Tanmay Jaimini

Are you a businessman?

Are you a freelancer?

Are you a tuition teacher?

Do you have a retail business?

Do you have a wholesale business?

And you want to file your income tax return?

And still, confused about how to file ITR?

How much tax do I have to pay?

Ahhhhhhhh so many questions in your mind

don't worry we have solutions to your all tax problems.

Read carefully

Suppose you are running a retail business. and your turnover for the year is less

than 2cr.

In such case, the government gives you the option to pay tax on your at least 8%

(in case of cash receipts) or 6% (in case of receipts otherthan cash i.e receipts in

bank) profit on a presumptive basis.

I want to say here

let's suppose your total turnover for the year is 75 lakh.

Here your profit will be presumed under this option will be at least (75 lacks * 8%

or 6%).

here your profit is at least 600000.

Now you are thinking that what are the benefits to me after opting for this

option?

In this option, the income tax department gives you the relaxation for not

maintaining the accounts and records.

This relaxation saves you Rs10000 to Rs15000 per month but how?

When you maintain your books of account of your business then you have to hire

an accountant which costs to you at least Rs10000 to Rs15000 per month.

now you are saving at least 120000 per year.

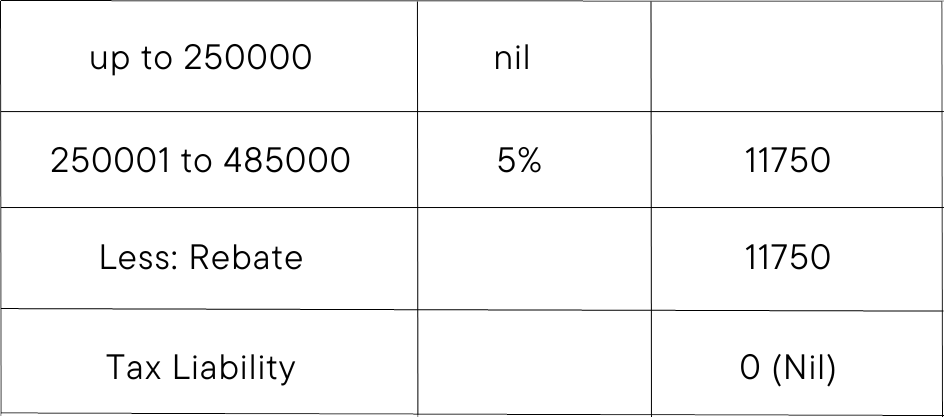

Now talk about how much tax you have to pay for the whole year.

In our example, you are earning 600000 business income besides taking some

other income like interest on a saving account and FD is 50000.

Here your total income is (600000+50000)= 650000.

Suppose you have some tax saving investments like medical insurance premium 15000, lic or tuition fee of children 150000.

Here your taxable income is (650000-15000-150000)= 485000.

Now tax liability is nil

Here you don’t have to pay any income tax and you are also saving accountants’ fees of Rs 120000 Per Annum.

PLAN YOUR TAXES WISELY

Read Out More Articles

Related Blogs

RENTAL INCOME FROM IMMOVABLE PROPERTY

Calculate your taxes basis Budget 2023. | You can still file ITR if you missed the last date. Get in touch with our Tax Experts.

DO YOU KNOW WHAT IS THE IDEAL TIME TO FILE AN INCOME TAX RETURN?

Calculate your taxes basis Budget 2023. | You can still file ITR if you missed the last date. Get in touch with our Tax Experts.

INFORMATION REGARDING TAXATION FOR SELF-EMPLOYED PEOPLE.

Calculate your taxes basis Budget 2023. | You can still file ITR if you missed the last date. Get in touch with our Tax Experts.

HOUSE RENT ALLOWANCE

Calculate your taxes basis Budget 2023. | You can still file ITR if you missed the last date. Get in touch with our Tax Experts.

GET TO KNOW ABOUT THE ANNUAL INFORMATION SYSTEM

INCOME TAX DEPARTMENT KNOWS ALMOST EVERYTHING ABOUT YOURFINANCIAL TRANSECTIONS. INCOME TAX DEPARTMENT KNOWS ALMOST EVERYTHING ABOUT YOURFINANCIAL TRANSECTIONS. Calculate your taxes basis Budget 2023. |