RENTAL INCOME FROM IMMOVABLE PROPERTY

- HRA Calculator

- Income From House Property

HRA Exemption Calculator

Summary

Your service request has been completed!

We have sent your request information to your email.Summary

Your service request has been completed!

We have sent your request information to your email.What is Rental Income or income from house property?

Income from House Property refers to the rental income earned by a person from a house or property they have let out on rent. This income is considered taxable income under the Income Tax Act, and the property owner is required to pay taxes on the same.

Income from House Property is an important component of an individual’s taxable income. The owner of the property is required to pay taxes on the same as per the Income Tax Slab Rates. Understanding the Income from House Property provisions is essential to ensure proper compliance with the Income Tax Act.

What is Let-out Property?

A let-out property is a property that is rented out to tenants for a specific period of time in exchange for a regular rental income. It can be a residential property such as a house, or apartment, or commercial property such as an office, retail space, or warehouse.

What is self-occupied property?

A self-occupied property is a property that is owned and used by the owner as their primary residence, But Now, a homeowner can claim his 2 properties as self-occupied and the remaining house as let out for Income tax purposes.

Some Important Laws Related to let-out House Property You Have to Know

Standard Deduction allowed to everyone.

- You are allowed to claim a standard deduction of 30% of the net annual value of the property as a deduction from the rental income. This deduction is allowed to account for the expenses incurred on repairs, maintenance, and other miscellaneous expenses related to the property.

Deduction With respect to interest on housing loan

- Deduction in respect of interest on a housing loan in case of a self-occupied property is allowed a Maximum of Rs. 2,00,000.

- Deduction in respect of interest on a housing loan in case of a let-out property is allowed. ( No limit exists here, which means the total interest on a housing loan is allowed for the relevant year)

Deduction with respect to municipal and other taxes paid to local authority

- If municipal Tax (House tax) of let-out property is paid by the owner of the property then deduction of municipal tax is allowed.

Commercial Shop

- Shop being a building, rental income will be charged to tax under the head “Income from house property”.

Arrears of Rent

- The amount received on account of arrears of rent (not charged to tax earlier) will be charged to tax after deducting a sum equal to 30% of such arrears. It is charged to tax in the year in which it is received. Such an amount is charged to tax whether or not the taxpayer owns the property in the year of receipt.

Let out as well as self-occupied during the year

- At times a property may be let-out for some time during the year and is self- occupied for the remaining period (i.e., let-out as well as self-occupied during the year). For the purpose of computation of income chargeable to tax under the head “Income from house property”, such a property will be treated as let-out throughout the year and income will be computed accordingly. However, while computing the taxable income in the case of such a property, actual rent will be considered only for the let-out period.

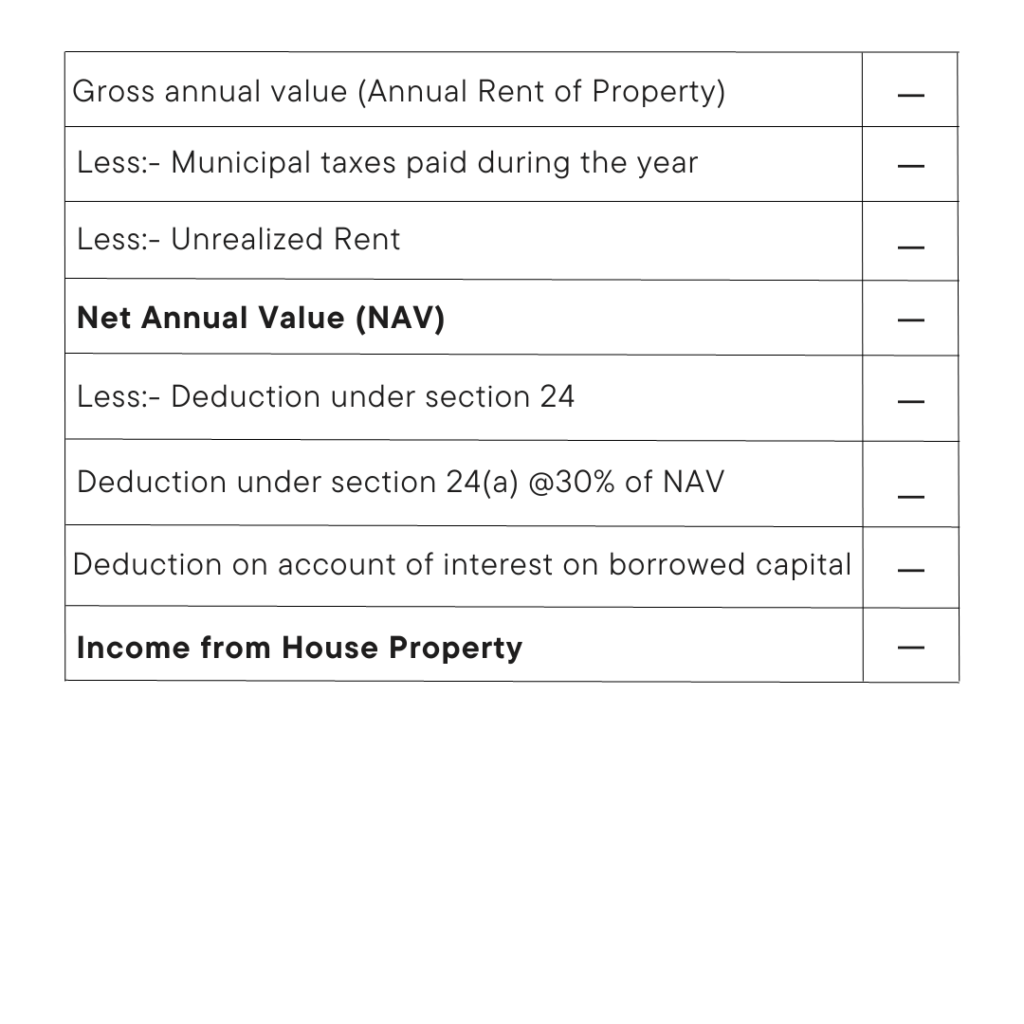

How to calculate taxable income from house property for income tax purposes?

Follow these steps

Read Out More Articles

Related Blogs

RENTAL INCOME FROM IMMOVABLE PROPERTY

Calculate your taxes basis Budget 2023. | You can still file ITR if you missed the last date. Get in touch with our Tax Experts.

DO YOU KNOW WHAT IS THE IDEAL TIME TO FILE AN INCOME TAX RETURN?

Calculate your taxes basis Budget 2023. | You can still file ITR if you missed the last date. Get in touch with our Tax Experts.

INFORMATION REGARDING TAXATION FOR SELF-EMPLOYED PEOPLE.

Calculate your taxes basis Budget 2023. | You can still file ITR if you missed the last date. Get in touch with our Tax Experts.

HOUSE RENT ALLOWANCE

Calculate your taxes basis Budget 2023. | You can still file ITR if you missed the last date. Get in touch with our Tax Experts.

GET TO KNOW ABOUT THE ANNUAL INFORMATION SYSTEM

INCOME TAX DEPARTMENT KNOWS ALMOST EVERYTHING ABOUT YOURFINANCIAL TRANSECTIONS. INCOME TAX DEPARTMENT KNOWS ALMOST EVERYTHING ABOUT YOURFINANCIAL TRANSECTIONS. Calculate your taxes basis Budget 2023. |